Important Changes Regarding 2014 Deductions

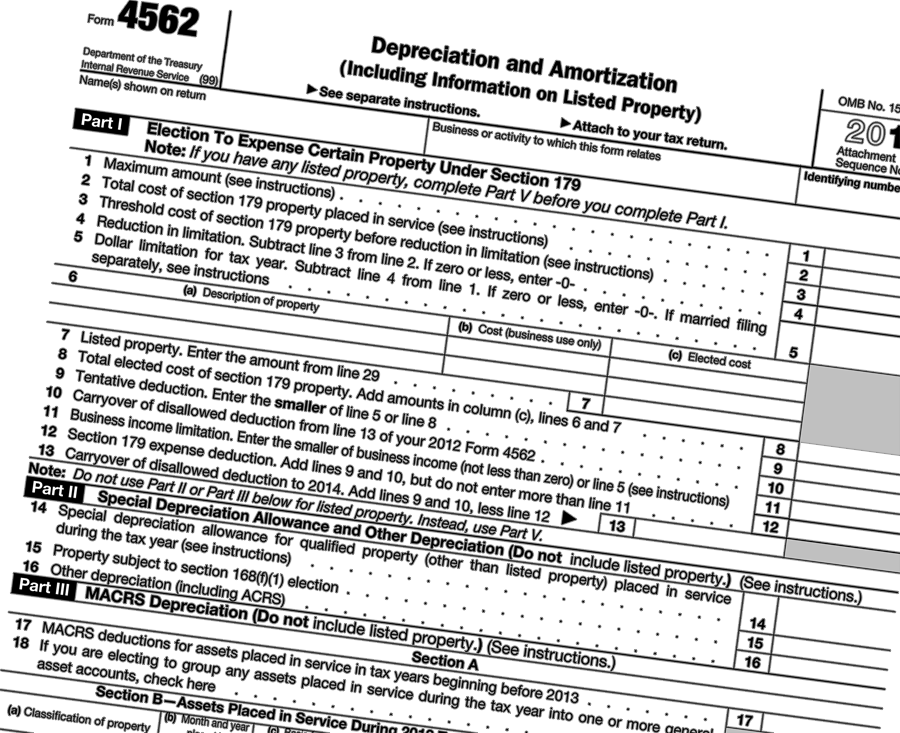

Effective in the year 2014, businesses are limited to only a $25,000 equipment expense deduction. In 2013, this limit was $500,000 for equipment.

Section 179: Equipment and property depreciation deduction

Additionally, Qualified leasehold improvements, qualified restaurant and retail improvements can be depreciated over 15 years if the asset is placed in service during 2013. For 2014, these assets will be depreciated over 39 years.

Note: This tax provision was reduced for 2014 by Congress, which may decide to restore previous levels.

For more information on section 179 deductions, visit IRS.gov, or contact us to discuss how this change affects your business tax filing.

Leave a Reply